Welcome to our Annuity Vault! Start with understanding the basics and then work up to hearing feedback from various professionals! Padlock Retirement wants to make things simple for you.

Quick Review: Basic Annuity Concepts

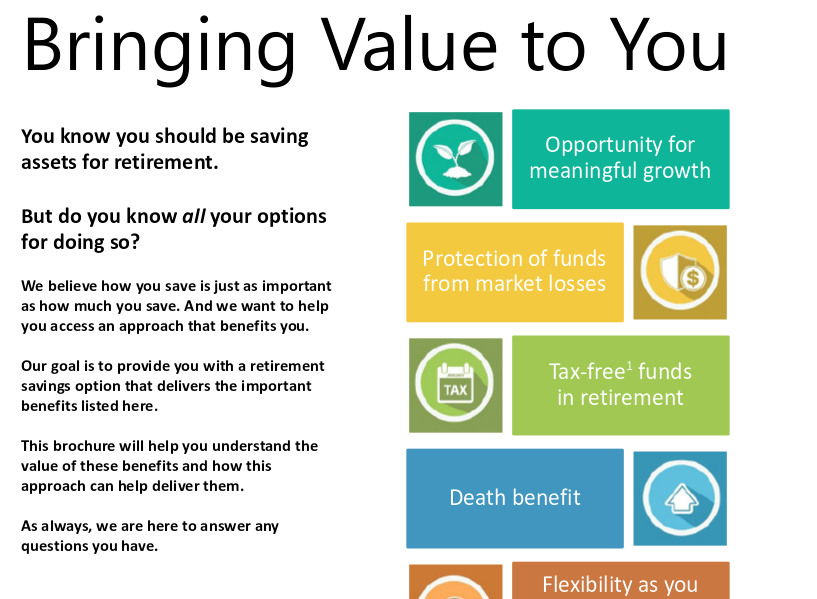

Annuities are a long-term investment, a lot of options containing a guaranteed income that can't be outlived. They also come crammed full of additional benefits such as variable growth potential, inflation protection and federal tax deferral for retirement purposes - making them an excellent choice for those who want reliable cash flow in their later years, without paying high taxes!

Annuity Video Library

Defusing Fed's Inflation |

Annuity Myths and Truths |

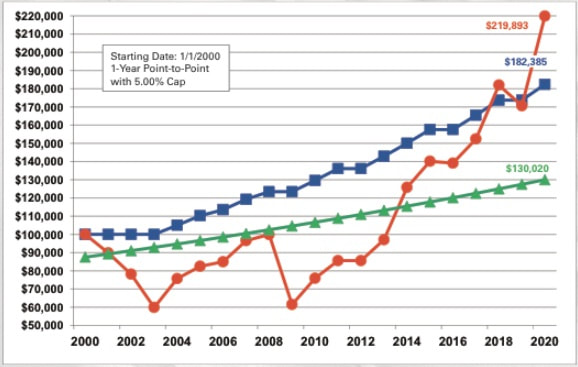

Market Volatility |

Overcoming Interest Rates |

Are You Looking For MORE?!

It's time to show you the next key to fully unlocking your financial potential, by visiting the Retirement Planning Vault. This section is chalk full of advanced concepts such as; Roth Conversion Strategies, Long Term Care, Tax-Free Income Planning, Upcoming Legislation, and Market Stress-Tests of what would happen during a "2008 crash".