Importance of Understanding Your Federal Benefits Federal employees play a critical role in the functioning of the US government, and they are entitled to a variety of benefits, including retirement benefits. Understanding these benefits is crucial for federal employees, as it can impact their financial future.

One of the primary reasons why federal employees should understand their retirement benefits is that it enables them to plan for their retirement effectively. Retirement planning involves considering various factors, such as the length of service, salary, and contributions made towards retirement plans. By understanding the benefits available to them, federal employees can estimate their retirement income and determine whether they need to supplement their income to achieve their retirement goals. Moreover, retirement benefits can have a significant impact on an individual's financial security. Retirement benefits provide a steady income stream for retirees, which is especially important given the increasing costs of living. Understanding the different types of retirement benefits, such as pension plans and the Thrift Savings Plan (TSP), can help federal employees make informed decisions about how to allocate their retirement savings and maximize their benefits. In addition to planning for retirement, understanding retirement benefits is essential for federal employees who may need to make career decisions that could affect their retirement benefits. For instance, federal employees may have to choose between staying with their current agency or accepting a job offer from another agency or the private sector. In such cases, understanding the impact of these decisions on their retirement benefits is crucial. Finally, understanding retirement benefits can help federal employees make informed decisions about their health care benefits. For example, retirees can enroll in the Federal Employees Health Benefits (FEHB) program, which provides access to health insurance coverage for themselves and their eligible family members. By understanding the different options available, federal employees can choose the health care plan that best fits their needs and budget. In conclusion, understanding retirement benefits is critical for federal employees, as it can impact their financial future, career decisions, and health care coverage. It is essential for federal employees to educate themselves about the different retirement benefits available to them to make informed decisions about their future.

0 Comments

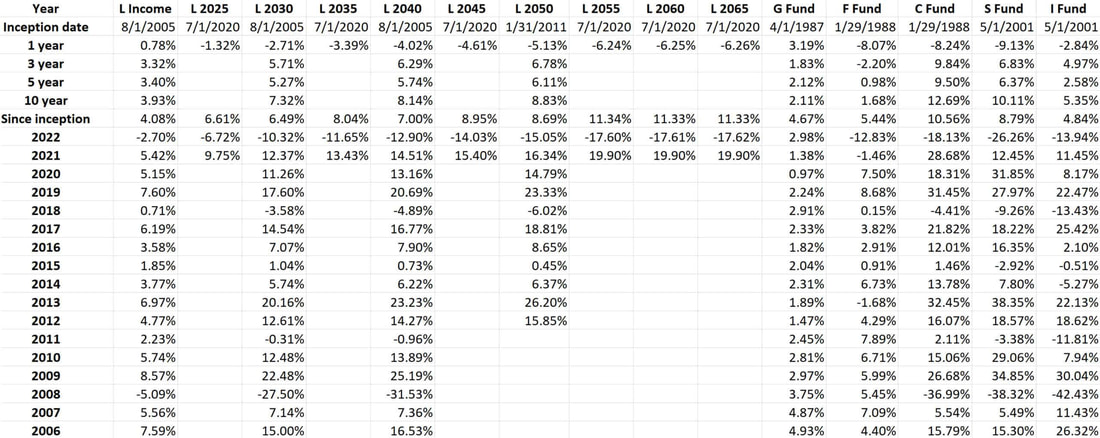

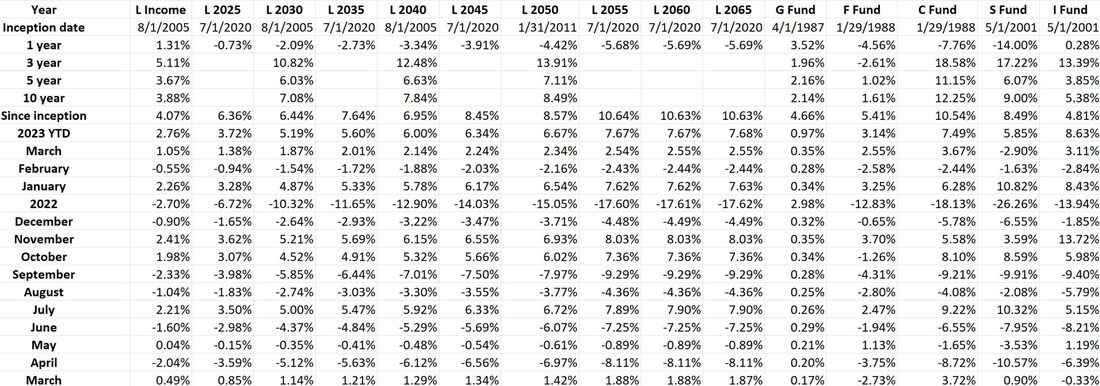

Below are the TSP fund performance figures for the G, F, C, S, I and L investment funds as calculated by the Thrift Savings Plan. A description of each TSP fund for those who need it can be found at the following resource: Click here! Before getting into the 2023 numbers, we wanted to show you last years performance! Now time for the 2023 performance... Recently, we have seen a lot of federal employees still hanging out in the S&C fund, which are the more aggressive options that can help you earn higher growth to funds, yet pose a big danger for looming financial woes. Simply put, you could lose a lot of money like federal employees retiring around 2007-2008. If you are nearing retirement and haven't given thought to how much money you are comfortable losing, it's time to get serious about what you have and what you need for the future.

“TSP owners should be wary of volatility in the markets and have a plan of action ready to deploy.” -Eddie Bennett  If you’re one of the nearly 100,000 TSP millionaires who invested for the long term by putting cash in the C, S, or I funds, you’ve probably done very well over the last few years. While the stock market reached record highs in June 2021, it has since been more volatile as investors wait to see how the Federal Reserve reacts to inflation and other risks. However, a growing number of investors and financial educators believe that significant market declines are inevitable, possibly in early to mid-2022. These declines, which will impact the value of your current TSP Fund, might be further exacerbated by issues such as changes in the government’s monetary policy, terrorist attacks, climate change, or a resurgence of the COVID-19 virus. The unpredictability of life means that stock and bond market predictions are, at best, educated guesses and not exceptionally reliable or useful. We do know that, based on history, dramatic market declines are sure to occur at some point. If you have a TSP, you need to have a Plan B to deploy when the market begins to go sideways. Here are some tactics TSP owners can employ to help them get through a period of market downturns and instability and stay on track with their long-term goals. Pause, inhale and stay focused. In many cases, avoiding panic and doing nothing at all might be a wise course of action. Market mood swings over short time intervals are normal. Talk to your financial expert to see if a “wait and see” attitude is a good choice. Keep up with your contributions. When you put money into your TSP during a down period, you are buying stocks on sale. Since the initial 5% of basic pay you contribute gets a 100% match, saving at least 5% makes sense since doing so gives you a de facto immediate return of 100%. Talk to your advisor about rebalancing your portfolio. Every fund in a TSP is affected differently by a market correction due to their differing investment mixes. In a situation where there is volatility, some funds might move beyond your desired asset allocation. If that happens, a rebalance may be in order. Ask yourself if it’s time to do a rollover. Transferring TSP funds into an IRA as a full or partial rollover can make sense for many federal retirees. While it is true that your TSP offers solid investment options to grow your money, it doesn’t provide much in the way of asset diversity, tax efficiency, investment selection, or flexibility. An IRA can give you more variety, flexibility, and a sustainable stream of income throughout retirement. Depending on your unique risk tolerance, certain kinds of annuities might make sense as well. Be sure to consult with a qualified professional to see what options, or combination of options, will work most efficiently in your situation. Summing it up: TSP investors need to understand that periods of market volatility and financial crises occur regularly. They also, thankfully, end. Instead of worrying, focus on the things you can control, meet regularly with your advisor, and keep an eye on all your retirement accounts. Diligence and long-term thinking almost always pay off. Read more published articles from Joe Runza at: https://annuity.com/what-should-you-do-with-your-tsp-if-the-markets-become-volatile/ |

Details

CategoriesAuthorPadlock Retirement Archives

May 2023

Categories |