Unlock Secrets To Maximizing Benefits

Padlock Retirement's big focus is educating Federal agencies and all of their employees about ways to "beat the system" of Federal Benefits and how to get the absolute most out of what you deserve!

We know what it means to serve our country! This is our service as a thank you!

We know what it means to serve our country! This is our service as a thank you!

The core objective of this educational vault, is to provide the education Federal employees need to make more informed decisions regarding their retirement, risk management, & benefits. While OPM tells you the hard facts, we help you navigate those options. Since there are tons of different benefits through the government, we will start simple!

Important Retirement BenefitsFor Every Federal Employee

Federal Employee Group Life Insurance

|

You pay two-thirds of the total cost while the government pays one-third.

|

Thrift Savings PLan (TSP)

TSP stands for the Thrift Savings Plan. The TSP is an important benefit designed to help you save for your future. The TSP is comparable to a private-sector tax-deferred 401(k) plan.

You can participate in the TSP if you are covered by FERS, CSRS, or CSRS Offset.

You can participate in the TSP if you are covered by FERS, CSRS, or CSRS Offset.

|

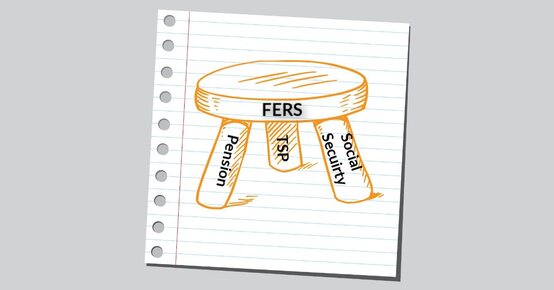

The TSP is especially important for FERS employees because it is one of three parts of your retirement coverage. Beginning July 1, 2001, FERS employees can contribute as much as 11% of basic pay each pay period, up to the IRS annual limit.

(The IRS limit for 2001 is $10,500.) As a FERS employee, you can receive 2 types of agency contributions to your TSP account, which together can equal as much as 5 percent of your basic pay. |